TRUSTMF Arbitrage Fund

An open-ended scheme investing in arbitrage opportunities.

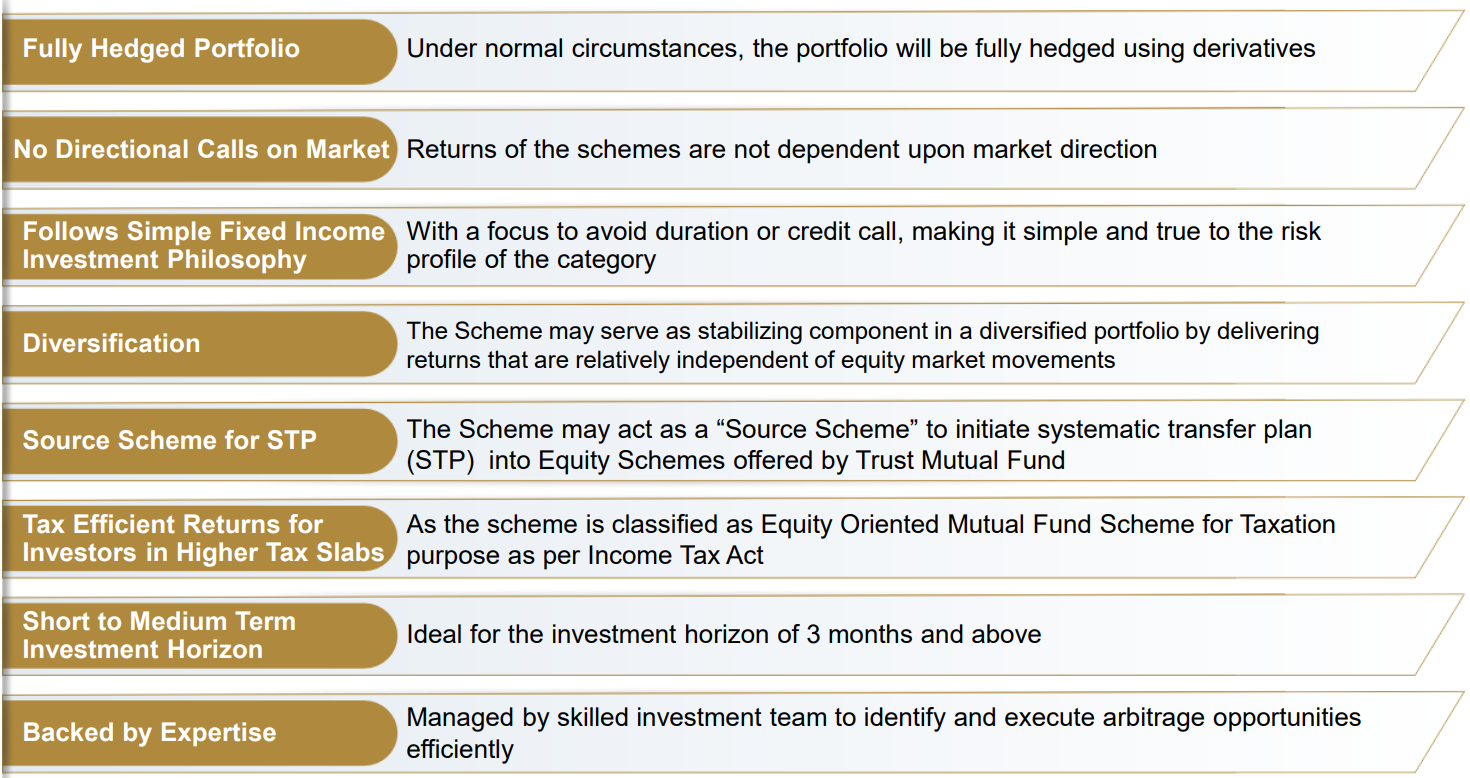

Benefits of investing in TRUSTMF Arbitrage Fund

Investment objective

The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market, and the arbitrage opportunities available within the derivative segment and by investing the balance in debt and money market instruments. There is no assurance that the investment objective of the scheme will be realized.

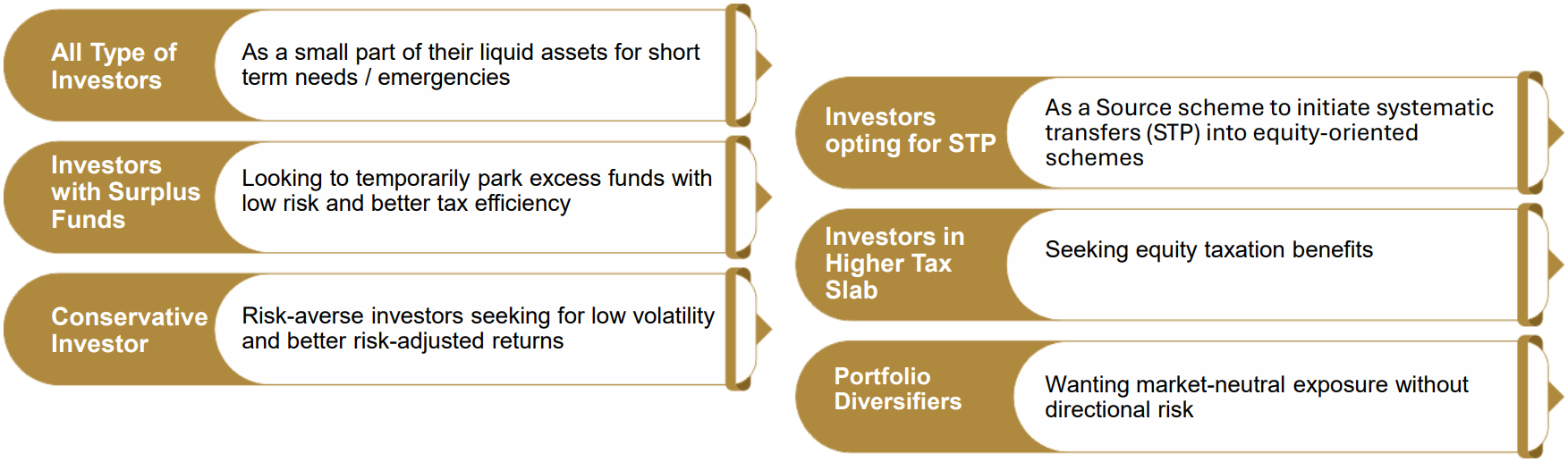

Who should invest in Arbitrage Funds?

Fund Managers

Mihir Vora

CHIEF INVESTMENT OFFICER

Over 30 years of experience in Fund Management across various verticles in financial services industry.

Worked as Senior Director & Chief Investment Officer at Max Life Insurance managing INR 1.3 Lac Cr AUM.

Held senior roles at Abu Dhabi Investment Authority, HSBC Mutual Fund, ICICI Prudential Mutual Fund, SBI Mutual Fund and others.

Proven track record across various asset classes including equity, fixed income, real estate, and alternative investment funds.

Sachin Parekh

FUND MANAGER & DEALER

Over 20 years of experience in the financial services industry, with a focus on broking and mutual funds, out of which over 6 years of experience as a Fund Manager.

Worked with leading institutions including Tata Asset Management, BOI AXA Investment Managers, IDFC Securities, Sharekhan Ltd., and Systematix Shares & Stocks.

Key Features

Name of the Scheme

TRUSTMF Arbitrage Fund

Type of Scheme

An open-ended scheme investing in arbitrage opportunities.

Benchmark

NIFTY 50 Arbitrage Index

Plans & Options

Regular Plan and Direct Plan.

Growth Option Only

Entry and Exit Load

Entry Load: Nil

Exit Load: 0.25% If redeemed / switched out within 7 days from the date of allotment. Nil - if redeemed/ switched out after 7 days from the date of allotment.

Minimum Investment Amount

Purchase (Incl. Switch-in) Minimum of Rs.1,000/- and in multiples of any amount thereafter.

Fund Managers

Mihir Vora and Sachin Parekh.

NFO Period

18th Aug – 22nd Aug 2025.

Downloads

Riskometer and Product Suitability Label

This product is suitable for investors who are seeking*:

Short to Medium Term return generation.

Predominantly investing in arbitrage opportunities in cash and derivatives segment of the equity market.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them

Scheme Riskometer

Arbitrage Fund

The risk of the Scheme is Low

Benchmark Riskometer

NIFTY 50 Arbitrage Index

The risk of the Benchmark is Low

Risk Factors and Disclaimers

In the preparation of the contents of this document, the AMC has used information that is publicly available, including information developed in-house. While due care has been taken to prepare this information, the AMC does not warrant the accuracy, reasonableness and/ or completeness of any information. This document represents the views and must not be construed as an investment advice. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions. However, they should not be considered as a forecast or promise, and performance or events could differ materially from those expressed or implied in such statements. Investors are requested to make their own investment decisions, based on their own investment objectives, financial positions. The AMC (including its affiliates), the Mutual Fund, the trust and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, loss in any way arising from the use of this material in any manner. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time. All figures and other data given in this document are dated and may or may not be relevant at a future date. Prospective investors are therefore advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implications. Please refer to the scheme related documents before investing for details of the scheme including investment objective, asset allocation pattern, investment strategy, risk factors and taxation. Past performance may or may not be sustained in the future and should not be used as a basis of comparison with other investments.